What is YOY year-over-year?

Lastly, if you want to compare the difference between two consecutive quarters of the same year you can use QOQ (quarter-over-quarter). Economic indicators help experts track market changes and even economies of countries. Some of the most important ones are the GDP (gross domestic product), employment indicators, and CPI (consumer price index). When dealing with them, it’s best to analyze the data using the YOY approach. It gives the most precise predictions and that’s why investors often rely on using this method.

Through this, you’ll be able to keep your dashboard clean and avoid overcrowding it with unnecessary graphs. YoY is used by businesses to see how much growth (or loss) they’ve had over a specific time period. Now, divide the difference by last Quarter 1’s revenue to get the growth rate. Now, divide the difference by last July’s revenue to get the growth rate.

The seasonality of YOY approach

Alternatively, another method to calculate the YoY growth is to subtract the prior period balance from the current period balance, and then divide that amount by the prior period balance. As already mentioned, YOY as a measuring technique will showcase and compare two events on a yearly basis. For most businesses, that means using YOY to compare their revenue growth. YOY can be positive, negative or zero and it’s expressed in percentages. Year over year is often used to calculate profits and losses, but can also be used to compare almost any metric a business wants to analyze.

- Investors like to examine YOY performance to see how performance changes across time.

- The YOY approach lets businesses analyze their long-term performance without seasonal variations affecting it.

- YOY calculations are done to evaluate investment returns, company performance, economic trends, and so on.

- Additionally, since most people who use YoY are focused on finding the rate of growth from one year to the next, it’s easy for abnormalities to fall through the cracks.

- Year-over-year (YOY)—sometimes referred to as year-on-year—is a frequently used financial comparison for looking at two or more measurable events on an annualized basis.

- For example, in the first quarter of 2021, the Coca-Cola corporation reported a 5% increase in net revenues over the first quarter of the previous year.

Compounding is the process in which an asset’s earning from either capital gains or interest are reinvested to generate additional earnings over time. It does not ensure positive performance, nor does it protect against loss. Acorns clients may not experience compound returns and investment results will vary based on market volatility and fluctuating prices. You can determine the YoY growth rate by subtracting last year’s revenue number from this year’s revenue number. A positive result shows a YoY gain, and a negative number shows a YoY loss.

Disadvantages of Using YOY

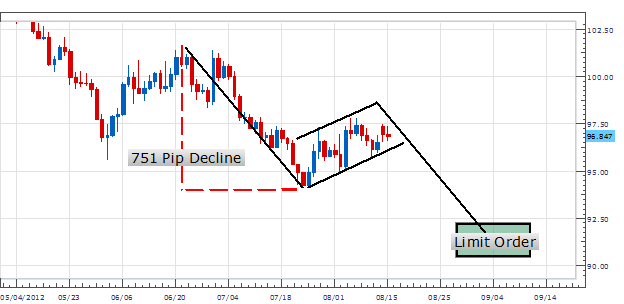

Both MTD and PMTD are useful in picking up and explaining quick trends in sales (sales pipeline metrics for example), marketing, financial, and any other business variables. They are most useful in businesses where keeping a handle on forex flag patterns small daily and monthly changes is important. Month-over-month does the same thing but on a monthly basis and would determine your monthly growth rate. This YoY analysis removes the monthly or quarterly volatility in your analysis.

Pros of YoY

Understanding where your financials stand and how they’re being used can offer valuable insights. If you were to compare a retailer’s Q3 and Q4 sales, you might think that the company grew a lot in Q4. But this quarter includes the holidays, which tend to lead to a lot of sales each year.

In this article we take a look at the inventory management in terms of KPIs and metrics, best practices and illustrate it with examples. If you want to ensure a steady rate of success for your business, monitoring and measuring year over year growth is essential. Keeping tabs on your YoY growth will allow you to set accurate benchmarks that you can work towards while giving you the insights to make key strategic decisions. Another instance where year over year growth calculations come into play is when you’re looking at how your direct competitors are performing. Now that you’re up to speed with the concept, we’re going to dig a little deeper.

Year-over-year analysis is used to compare the results in one period, such as a month, with the same period in the previous year. Year over year analysis is useful because it eliminates any cyclicality or seasonality that occurs during the year. The year-over-year calculation is useful because it gives you a direct apple to apple’s comparison with the same period from the prior year.

Slang.org is a community-driven dictionary and database of slang terms. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. That’s why organizations prefer to scale up to quarter-over-quarter (QoQ) and year-over-year (YoY) results. When you convert to a percentage, you find that the dealership’s MoM growth was 66.67% as of February. The value of business reports lies in how they present information clearly and concisely.

Why Should You Use YOY Calculations?

It’s a term you’ll hear frequently when considering investment returns because it allows you to look at changes in annual performance from one year to the next. Year-over-year is a growth calculation commonly used in economic and finance circles. Comparing how a variable does from one year to the next is an important way for a company to know whether certain areas of its business are growing or slowing down.

In finance, investors usually compare the performance of financial instruments on a year-over-year basis to gauge whether or not an instrument is performing expected. This analysis is also very useful when analyzing growth patterns and trends. There are some drawbacks to analyzing a business with a YoY rate.

In other words, you are assessing changes in quantity, performance, quality, or any other quantifiable measure one year compared to another. To calculate the YOY change between Year 1 and Year 2, you need to take $12M – $10M and divided the result by $10. On the other hand, a sequential analysis is when you are comparing a cycle with the cycle immediately prior to it. For example, if a company is analyzing its costs of goods sold (COGS) YOY in the course of the past three years, it can see whether it is on the right track in managing costs or not. By analyzing sales year-over-year, the company will average out the sales over the entire period getting a better sense of direction. You can compare any financial metric or quantifiable event using a year-over-year analysis.

YoY analysis is important because it provides a long-term gauge of growth while neutralizing for seasonality. By documenting key patterns over set timeframes from one year to the next, you can understand how your company is performing on a consistent basis. That’s why YoY comparisons can also be made for quarterly, monthly, day trading experts or annual performance. This is what makes this metric useful when you need to compare seasonal growth over two or more years. Understanding how to use accurate comparisons for financials will bring several benefits. YOY calculations help look into and find information about the financial performance of your business.

As important as YoY comparisons can be, they really aren’t enough to gauge a long-term investment plan. This example comes from a financial modeling exercise where an analyst is comparing the number of units sold in Q to the number of units sold in Q3 2017. This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication.

If the company wants to compare this season’s growth compared to last season, it will use YoY reports. For example, hotels that experience large spikes in occupancy during holidays how to buy nickel can measure seasonal trends and use them to derive strategies for increasing reservations. YoY measures the rate of change between two variables over two different years.

It is the smallest measurement of growth for a business that shows the increase or decrease in this month’s value of a certain variable as a percentage of the previous month. Year-over-year analysis is most commonly used when discussing financial or economic data, especially regarding growth. YoY data shows how a given variable increases or decreases from one year to the next.